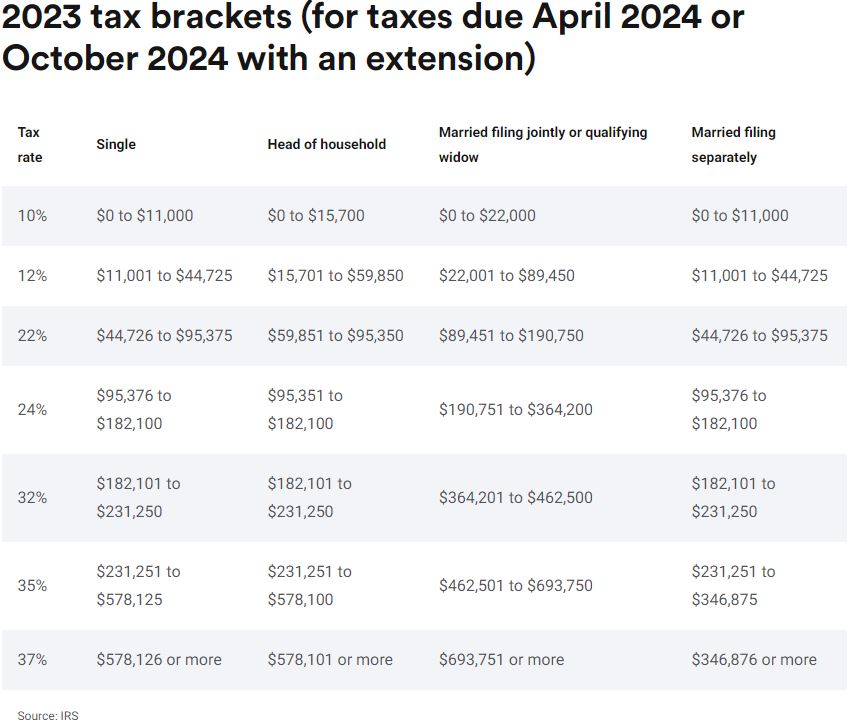

Taxpayers fall into one of seven brackets, depending on their taxable income: 10%, 12%, 22%, 24%, 32%, 35% or 37%. Because the U.S. tax system is a progressive one, as income rises, increasingly higher taxes are imposed.

The table displays tax brackets according to filing status: single, married filing jointly or qualifying widower, head of household and married filing separately. The IRS makes inflation adjustments each year.